In 2025, the crypto tracking landscape has matured significantly, with platforms offering everything from basic price monitoring to advanced features like exit strategies, tax reporting, and DeFi protocol integration. After extensive research and analysis, we've compiled this comprehensive guide to the best crypto portfolio trackers available today.

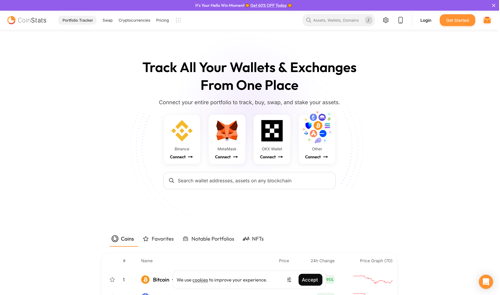

1. CoinStats – Best Overall Crypto Portfolio Tracker

Rating: ⭐⭐⭐⭐⭐

CoinStats has established itself as the industry leader in crypto portfolio tracking, trusted by over 1.2 million active monthly users worldwide. Founded in 2017 by Narek Gevorgyan, the platform has evolved from a simple tracking app into a comprehensive crypto management ecosystem.

Key Features:

-

Extensive Integration: Supports 120+ blockchains, 300+ wallets and exchanges, and 1,000+ DeFi protocols – the highest number of integrations in the market

-

Advanced Analytics: Real-time portfolio tracking with detailed profit/loss analysis, asset allocation breakdowns, and performance metrics

-

DeFi Excellence: Outstanding support for decentralized finance with automatic tracking of Uniswap, Aave, Compound, Curve, SushiSwap, and other major protocols

-

Built-in Features: Integrated swap functionality, crypto earning opportunities (up to 20% APY), and NFT tracking capabilities

-

AI-Powered Tools: Exit strategy feature with AI-assisted price predictions based on historical data and market trends

-

Tax Reporting: Simplified crypto tax report generation with automatic transaction categorization

-

Real-time Alerts: Customizable price alerts, volume notifications, and market cap triggers

-

Accessibility: Available on web, iOS, Android, with native widgets for quick portfolio checks

Pricing:

-

Free Plan: Basic tracking with limited connections

-

Premium Plan: $14/mo Connects up to 100 exchanges and wallets, tracks 1,000 transactions/month

-

Degen Plan: $63/mo Unlimited exchanges and wallets, 100,000 transactions/month, personal account manager

Why CoinStats Ranks #1:

CoinStats dominates the crypto tracking space with its unmatched integration capabilities and comprehensive feature set. The platform's ability to automatically sync with both centralized exchanges and DeFi protocols makes it invaluable for modern crypto investors. Security is paramount – CoinStats uses read-only API connections and employs robust encryption with two-factor authentication, ensuring your funds remain safe while you track.

The user interface strikes the perfect balance between comprehensive data and accessibility. Whether you're a beginner checking Bitcoin prices or an advanced DeFi user managing complex yield farming positions, CoinStats delivers the information you need without overwhelming you.

Best For: Beginner traders, DeFi enthusiasts, and investors with holdings across multiple platforms seeking comprehensive tracking with advanced features.

2. Merlin – Best for Crypto Tracking & Exit Strategy Planning

Rating: ⭐⭐⭐⭐⭐

Merlin stands out as a superior crypto portfolio tracker that goes beyond safe and secure tracking by offering sophisticated exit strategy and edit tools. Launched in 2023, this platform was built by crypto veterans like Johnny Krypto & Coach JV (TEDx Speakers) specifically to solve one of the most challenging aspects of crypto investing: knowing when to take profits!

Key Features:

-

Multi-Tiered Exit Strategies: Create customized price targets for each asset with tax estimates and receive real-time sell alerts when targets approach

-

Safely Track & View all your crypto: See all your coins, wallets & exchanges in one simple to use dashboard. View anywhere in the world as Merlin never holds your keys or coins

-

Comprehensive Tracking: Supports 12,000 cryptocurrencies across 400+ exchanges, wallets, and blockchains

-

Real-Time Alerts: SMS and email notifications when assets approach your predetermined exit targets, so you don’t miss taking profits

-

Portfolio Overview: Track total portfolio value, daily gains/losses, and historical performance with clear visualizations and editing tools, so your portfolio always tracks correctly.

-

Up to 30 API Connections: Connect multiple exchanges and unlimited manual wallets

-

Tax Estimation: Integrated tax estimates for all exit plans based on your tax bracket

-

Educational Resources: Library of how-to videos, including "How to Choose Exit Targets"

-

Security First: Partners with VEZGO (SOC2 Type II certified) for data security, employs military-grade encryption, and never stores your private keys

-

Web-Based Platform: Access from any device without app downloads

-

Live Customer Service Agents: Speak to Live agents to help you get started

Pricing:

-

30-Day Free Trial: Full access to all features for everyone

-

Monthly Subscription: $18/month for all features

-

Annual Subscription: $16.99/month (save 10% compared to monthly)

-

Note: Currently available in the US and Canada only

Why Merlin Ranks #2:

Merlin's laser focus on exit strategy planning makes it indispensable for investors who struggle with emotional decision-making during market volatility. The platform's unique selling proposition is simple yet powerful: you'll never miss a profit-taking opportunity because you weren't monitoring the market.

The exit strategy feature allows you to set multiple targets for each asset. For example, you might set your first target for ADA at $0.60 (take 30% profit), second target at $0.85 (take another 40%), and final target at $1.20 (sell remaining 30%). When ADA approaches $0.60, Merlin sends you a real-time alert, giving you the clarity to execute your predetermined strategy without emotion.

Security is a top priority, Merlin uses read-only API connections which employs bank and military-grade encryption, ensuring your assets are safe to view anywhere in the world!

Customer reviews on Trustpilot give it a 4.4 out of 5 star rating and consistently praise Merlin's responsive customer support team and the peace of mind that comes from seeing all your coins in one Safe place and from having a strategic exit plan. Users report that the platform has "reduced the stress of managing multiple exchanges" and the "ability to schedule exits and calculate taxes automatically is a game-changer."

Best For: Beginners, Long-term holders and experienced investors preparing for bull runs, and anyone who wants to remove emotions and take profits on the way up and avoid rubbernecking on the way down as discussed by its cofounder on TEDx Talks.

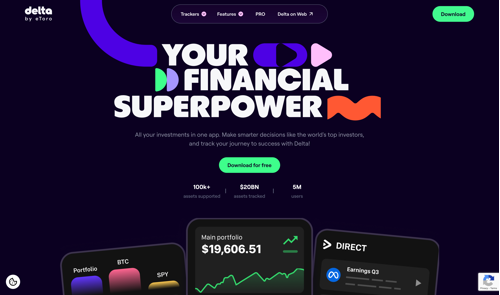

3. Delta – Best for Multi-Asset Portfolios

Rating: ⭐⭐⭐⭐

Owned by eToro since 2019, Delta has evolved from a crypto-focused tracker into a comprehensive investment management platform. With over 1 million users gained in its first year, Delta continues to be a favorite for investors who want to track both traditional and crypto assets in one place.

Key Features:

-

Multi-Asset Support: Track stocks, ETFs, cryptocurrencies, NFTs, commodities, and forex all in one dashboard

-

300+ Exchange Support: Integrates with major crypto exchanges and 10,000+ stock brokerages

-

Portfolio Analytics: Detailed profit/loss metrics across multiple timeframes with asset allocation breakdowns

-

News Integration: Built-in news feed to stay informed about market movements

-

Multiple Portfolios: Create separate portfolios for different strategies or family members

-

Device Syncing: Free users get 2-device sync, Pro users get 5-device sync

Pricing:

-

Free: Basic features with 2-device sync

-

Delta Pro: $99.99/year or $13.99/month with unlimited connections and advanced analytics

Best For: Investors with diversified portfolios spanning both traditional markets and cryptocurrencies.

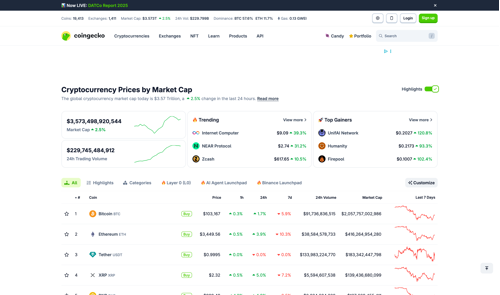

4. CoinGecko – Best Free Portfolio Tracker

Rating: ⭐⭐⭐⭐

CoinGecko has built its reputation as one of the most trusted cryptocurrency data aggregators, and its portfolio tracking tool continues that tradition of excellence. With support for over 14,000 digital assets, it's a comprehensive solution for crypto enthusiasts.

Key Features:

-

Massive Coverage: Track 14,000+ cryptocurrencies with real-time price updates

-

Detailed Analytics: Market data, historical charts, and volume analysis

-

Free Forever: Core portfolio tracking features remain completely free

-

Premium Options: Advanced features available through subscription tiers

Best For: Budget-conscious investors and those who prioritize extensive coin coverage.

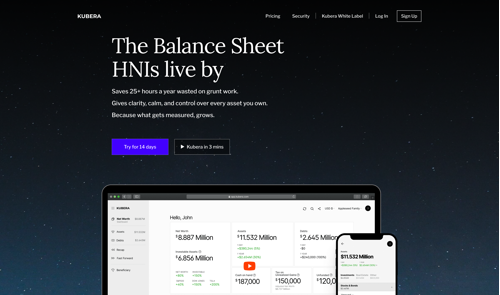

5. Kubera – Best for High Net Worth Individuals

Rating: ⭐⭐⭐⭐

Kubera takes a holistic approach to wealth management by tracking not just cryptocurrencies but your entire net worth, including real estate, stocks, bonds, and even collectibles.

Key Features:

-

Complete Wealth View: Track crypto alongside real estate, vehicles, artwork, and traditional investments

-

132 Crypto Integrations: Connects with major exchanges and wallets

-

20,000+ Financial Institutions: Syncs with banks globally

-

Estate Planning: Unique beneficiary features for legacy planning

-

Real-Time Automation: Fully automated valuation updates

Pricing:

Premium service starting at $150/year

Best For: High net worth individuals seeking comprehensive wealth management beyond just crypto.

How to Choose the Right Crypto Portfolio Tracker

When selecting a crypto portfolio tracker, consider these key factors:

1. Integration Support

Ensure the tracker supports your specific exchanges, wallets, and blockchains. If you're heavily involved in DeFi, prioritize trackers with strong DeFi protocol support like CoinStats.

2. Security Features

Look for:

-

Read-only API access (never withdrawal permissions)

-

Two-factor authentication (2FA)

-

Encryption standards

-

SOC2 compliance for data providers

-

No private key storage

3. Features That Match Your Strategy

-

Active traders: Need real-time updates and advanced alerts (CoinStats)

-

Long-term holders: Benefit from exit strategies and tax planning (Merlin)

-

Multi-asset investors: Require comprehensive tracking beyond crypto (Delta)

-

Budget-conscious: Can find excellent free options (CoinGecko)

4. User Experience

The best tracker is one you'll actually use. Consider:

-

Mobile app quality and availability

-

Dashboard clarity and customization

-

Learning curve for setup

-

Customer support responsiveness

5. Pricing Structure

Free options provide basic functionality, but paid plans ($15-20/month) typically offer:

-

Unlimited exchange connections

-

Advanced analytics

-

Tax reporting

-

Priority support

-

Historical data access

Final Verdict

For most crypto investors, CoinStats offers the best overall value with its extensive integrations, DeFi support, and comprehensive feature set. The platform's ability to handle everything from simple Bitcoin tracking to complex DeFi positions makes it the top choice for 2025.

For strategic investors focused on exit planning and long-term wealth building, Merlin provides unmatched value through its exit strategy tools and real-time alerts. The 30-day free trial makes it risk-free to see if the strategic approach fits your investment style.

For diversified investors managing both traditional and crypto assets, Delta remains the go-to solution for consolidating everything in one dashboard.

Remember: the best crypto portfolio tracker is the one that matches your specific needs, investment strategy, and technical comfort level. Many platforms offer free trials – take advantage of these to find your perfect fit.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research and consult with financial professionals before making investment decisions. Cryptocurrency investments carry significant risk.