Inspired by Johnny Krypto’s TEDx Talk: "Crypto Roller Coaster: Master Your Emotions"

Here's the uncomfortable truth: 95% of crypto traders lose money, and it's not because they can't read charts.

It's because most traders don’t have a crypto exit plan to manage their emotions.

Johnny isn't a financial advisor. He's lived through Bitcoin's rise to $125,000 and Covid crash to $3,800. Through years of market chaos, he learned that success comes down to emotional control.

The market doesn't determine your outcome. Your reaction to it does.

And if you don't have an exit plan before emotions take over, you're already losing.

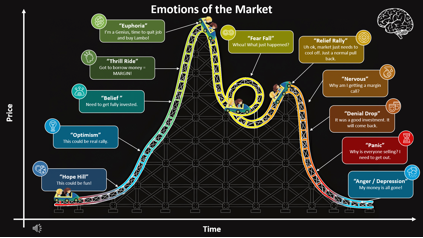

The Emotional Roller Coaster Nobody Warns You About

Johnny compares crypto trading to a roller coaster, and the metaphor is perfect. The ride starts with excitement as prices climb. Your portfolio turns green. That $5,000 investment becomes $10,000, then $15,000. Each uptick brings confidence that you made the right choice. You start looking for more money to get fully invested, or you borrow on margin so you can go all in.

Before long, excitement becomes intoxicating. Your coin hits new highs. Suddenly you're on top of the world, planning to quit your job, calculating potential millions, researching luxury cars, considering early retirement. This the ultimate Euphoria moment! But, its also the most dangerous moment on the ride.

Because at the peak of the rollercoaster ride, logic disappears. Johnny calls this the "rubberneck moment" when you’ve watched the price go WAY up and you're convinced it’ll never stop going up

And if you haven’t taken profits on the way up, you’re probably going to watch it go all the way back down!

Then the market turns. A regulatory announcement. A major exchange hack, etc.… and BOOM, the price drops 40% in days (remember the FTX collapse?), now you’re getting margin calls and that Euphoria becomes Panic.

That same investment you were sooo sure would make you rich? Now you have to sell it at a massive loss, angry and looking for someone to blame. The whales. The government. Bad timing.

But as Johnny reminds his TEDx audience: "The entire cycle wasn't Wall Street manipulating you. It was your emotions and fear of missing out (FOMO) that cost you money."

The Psychology Behind Why Traders Fail

Let's examine what happens in your brain during these swings. When Bitcoin runs from $60,000 to $120,000, your brain releases dopamine, a neurotransmitter that makes us feel pleasure, satisfaction, and excitement. It’s the same chemical that makes gambling addictive & why some traders can’t sell.

You're no longer investing; you're chasing a high.

Studies show retail investors underperform the market by 5.35% annually. Not because they pick bad assets, but because they buy during euphoria and sell during panic. They do the opposite of what works.

Crypto amplifies these psychological traps:

-

24/7 trading creates obsessive chart watching

-

Extreme volatility triggers constant fight-or-flight responses

-

Social media spreads FOMO and FUD at unprecedented speed

-

No circuit breakers mean crashes happen faster than you can react

-

Media tells you prices are going higher when they probably aren’t

The "diamond hands" culture makes everything worse. The community celebrates holding through 80% drawdowns as heroic. But Johnny's data tells a different story: systematic profit-taking outperforms blind holding in 73% of market cycles.

Think about it. Those who held Bitcoin from $69,000 in 2021 through the crash to $15,500 in 2022 and back to $110,000 today? They're still celebrating breaking even while smart traders who took profits and rebought lower doubling their stack.

Two Rules That Separate Winners from Losers

After years of trading and teaching, Johnny identified two rules that he thinks can help traders achieve success:

Rule 1: Never Try to Catch the Top

Trying to sell at the absolute peak is impossible. Those who chase tops become rubberneckers, watching prices climb all the way up and all the way down.

They’re paralyzed by greed, convinced each day's high will be tomorrow's low.

Professionals know better. They take profits systematically on the way up and down, for example:

-

Sell 25% at 50% return to make sure to secure a profit

-

Sell 25% at 2x return

-

Sell 35% at 3x

-

Keep 10 to 15% for potential moonshot: Or, as Johnny calls it, “schmuck insurance”

-

Never regret leaving money on the table

Example: You buy Ethereum at $3,000. Instead of hoping for $10,000, you:

-

Sell 25% at $4500 to secure a profit

-

Sell 25% at $6,000 (lock in double)

-

Sell 35% at $9,000 (triple your money)

-

Keep 10 to 15% for a potential moonshot / long term holding

While others ride from $9,000 back to $2,000, you've already secured profits on the way up, which you can now reinvest if you want.

Rule 2: Create Your Exit Plan Before Emotions Take Over

An exit plan isn't just strategy. It's protection from your future emotional self. The best time to decide when you'll sell? Before you buy. The worst time? When you're up 500% and dreaming about yachts!

Johnny's framework is simple but powerful:

-

Before buying, write down 3 or 4 price targets where you'll take profits (learn to use the fibonacci tool for determining price targets)

-

Set alerts at those levels so you don't have to watch charts

-

Execute the plan regardless of what influencers say

-

Review results to reinforce disciplined behavior

Without an exit plan, the market will create one for you through margin calls, forced liquidations, and panic selling. And that plan usually always ends badly for the retail investor.

Your Pre-Trade Emotional Checklist

Before making any crypto trade, run through this checklist:

✓ Exit prices written down (specific numbers, not "when it feels right")

✓ Stop-loss set (define your maximum % loss, no exceptions)

✓ Position sized correctly (never risk more than 5% of portfolio)

✓ Emotions checked (excited = follow exit plan, fearful = follow exit plan)

✓ Plan shared with someone (accountability prevents impulsive changes)

Can't check all five boxes? Don't make the trade. This simple checklist would prevent 90% of your trading losses.

The Hidden Cost of Emotional Trading

Let's compare two traders with the same $10,000 starting capital:

The Emotional Trader:

-

Buys Bitcoin at $100,000 after reading bullish tweets (FOMO)

-

Watches it hit $122,000 but doesn't take any profits ("it's going to $200k!")

-

Holds through crash to $45,000 ("diamond hands!")

-

Finally sells everything at $40,000 in despair

-

Result: $6,000 loss (60% drawdown)

The Systematic Trader:

-

Buys Bitcoin at $70,000 during fear

-

Sells 25% at $105,000 (1.5x)

-

Sells 20% at $125,000 (ATH)

-

Sells 30% at $140,000 (2x)

-

Keeps 25% for the moon shot

-

Result: Profits locked, risk reduced, upside preserved

Both traders had the same opportunity. One lost 60%. The other made consistent profits. The only difference? The latter had the emotional discipline to create (and follow) an EXIT PLAN… which is the main difference between losing and winning traders.

Reading Market Psychology Like a Pro

Emotional intelligence becomes your trading edge when you understand that charts reflect crowd psychology. Every pump and dump represents millions of people experiencing the same emotions simultaneously.

Key signals Johnny watches:

-

Laser eyes on Twitter profiles = Market top approaching, take profits

-

"Crypto is dead" mainstream headlines = Bottom forming, start accumulating

-

Your hairdresser giving crypto advice = Retail mania peak, exit immediately

-

Suicide hotline pinned on crypto Reddit = Maximum despair, potential reversal

When you recognize these patterns, you stop being a victim of market psychology and start profiting from it. You sell into others' greed and buy into their fear. The principle is really simple: You do the opposite of what you think. The hard part is (you guessed it) doing the opposite of what you think!

Mastering this tactic will allow you to trade like a pro. Remember: I’s all about mindset!

Breaking the Diamond Hands Delusion

Here's Johnny's controversial truth: "Diamond hands" is propaganda spread by people who need exit liquidity. They need you to hold while they sell.

The math proves it. Someone who held Bitcoin from 2021's $69,000 peak is up 59% at today's $110,000. Sounds good? Not really. Traders who took profits at $60,000 and rebought at $20,000 tripled their Bitcoin stack. One approach gained 59%. The other gained 200%

The community won't tell you this because bag holders need believers. But professional traders know: taking profits isn't weakness… It's what the ‘smart money’ does!

Your Action Plan: From Emotional to Systematic

Ready to break the cycle? Here's your transformation roadmap:

Step 1: Face Your Trading Reality

Pull up your exchange history. Calculate how many trades were emotional versus planned. Most traders discover 80% of their losses come from emotional decisions.

Step 2: Create Your Trading Constitution

-

Maximum position size: 5% of total portfolio

-

Profit targets: 25% at 50% gain, 25% at 100% gain

-

Loss limit: 20% stop-loss on every position

-

Time rule: No trades within 24 hours of major news

-

Review schedule: Monthly performance analysis

Step 3: Build Your System

You need investing tools that enforce discipline when your brain goes haywire. Set price alerts instead of watching charts. Create exit orders when you enter positions. Keep a trading journal rating each trade's emotional level from 1-10.

Step 4: Track and Improve

Every month, review your trades. Which followed the plan? Which were emotional? What triggered the emotional trades? Use this data to refine your system.

Master Your Market Emotions with Merlin

Johnny didn't just identify the problem in his TEDx talk. He built the solution. Merlin removes your emotions from crypto investing… so you can play on a level field:

-

Exit Planning Tool: Create profit targets when calm, not when watching green candles

-

Automated Alerts: Get notified when it’s time to sell regardless of the news

-

Tax Estimates: See what you will owe Uncle Sam on trades before you make them

-

Best Portfolio Tracker: One clear dashboard instead of 20 anxiety-inducing tabs

-

LIVE Customer Support team: to help you get started

While others are panic selling at the bottom or FOMO buying at the top, Merlin users execute their predetermined plan. No emotion. No drama. Just disciplined profit-taking. Remember, the markets are a ZERO-SUM game: One person’s gains are another person’s losses!

The crypto market will always be an emotional roller coaster. The question isn't whether you'll experience fear and greed. It's whether you'll have systems in place to profit from it!

That’s why we invented Merlin, to give everyday investors a chance to win in the marketplace.

Start your free 30-day Merlin trial today. Set your first exit plan in 5 minutes. Execute it without emotion when the time comes.

Because as Johnny says: "The market doesn't care about your feelings. But your feelings can affect your profits."